‘SET HIGH GOALS’

About 11 years ago, financial planner Mike Walther enjoyed a good lifestyle, working for an advisory firm with a $5 million minimum. His wife asked him what he would find most rewarding in life going forward, and he realized he wanted to help families with special needs make better decisions and become more financially literate.

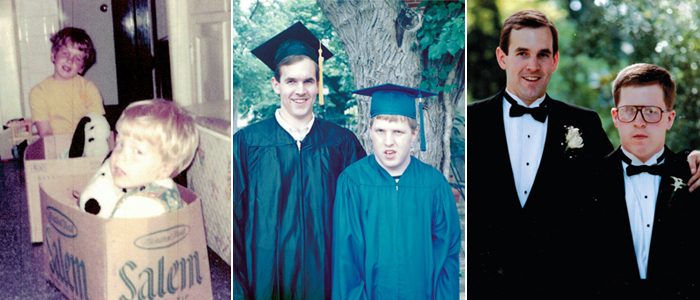

Mr. Walther’s younger brother had been formally diagnosed during his 30s with autism.

“In the 1970s, my parents had trouble finding the right resources for him,” he said. “Still, he obtained a high school diploma and now has a satisfying job in a public library and participates in social activities. Now I want to set high goals for all the families.”

ENCOURAGE LONGER-TERM PLANNING

Mr. Walther, 50, discovered that most special needs families are so overwhelmed with immediate tasks, like therapy sessions, doctor visits or insurance, that they can hardly “think past Friday.”

He tries to relieve some of that burden and encourages longer-term planning.

For example, even wealthy clients often need access to government resources like Supplemental Security Income, so he suggests planning as early as age 13 if possible. Otherwise, the government’s five-year look back period targets any assets in the child’s name.

He also uses a nonlegal electronic care guide to spell out a special needs person’s likes, dislikes, eccentricities and routines for any future caregivers in years to come.

It sounds simple, but Mr. Walther’s primary advice to other planners is to take great care in communicating with these families.