-Please find important disclosures about this resource HERE.

Hi, I'm Mike Walther from Oak Wealth Advisors with a different approach to planning.

I want everyone to think about what's...

Our Guest Speaker: Ellie Rosenthal Strisik, Creator of College for All, an online platform that offers various resources to neurodivergent...

Our Guest Speaker: Ryan Niemiller is a standup comedian who rose to fame after finishing in 3rd place on season...

Mike Walther, Founder and President of Oak Wealth Advisors with your June 2025 market update. ...

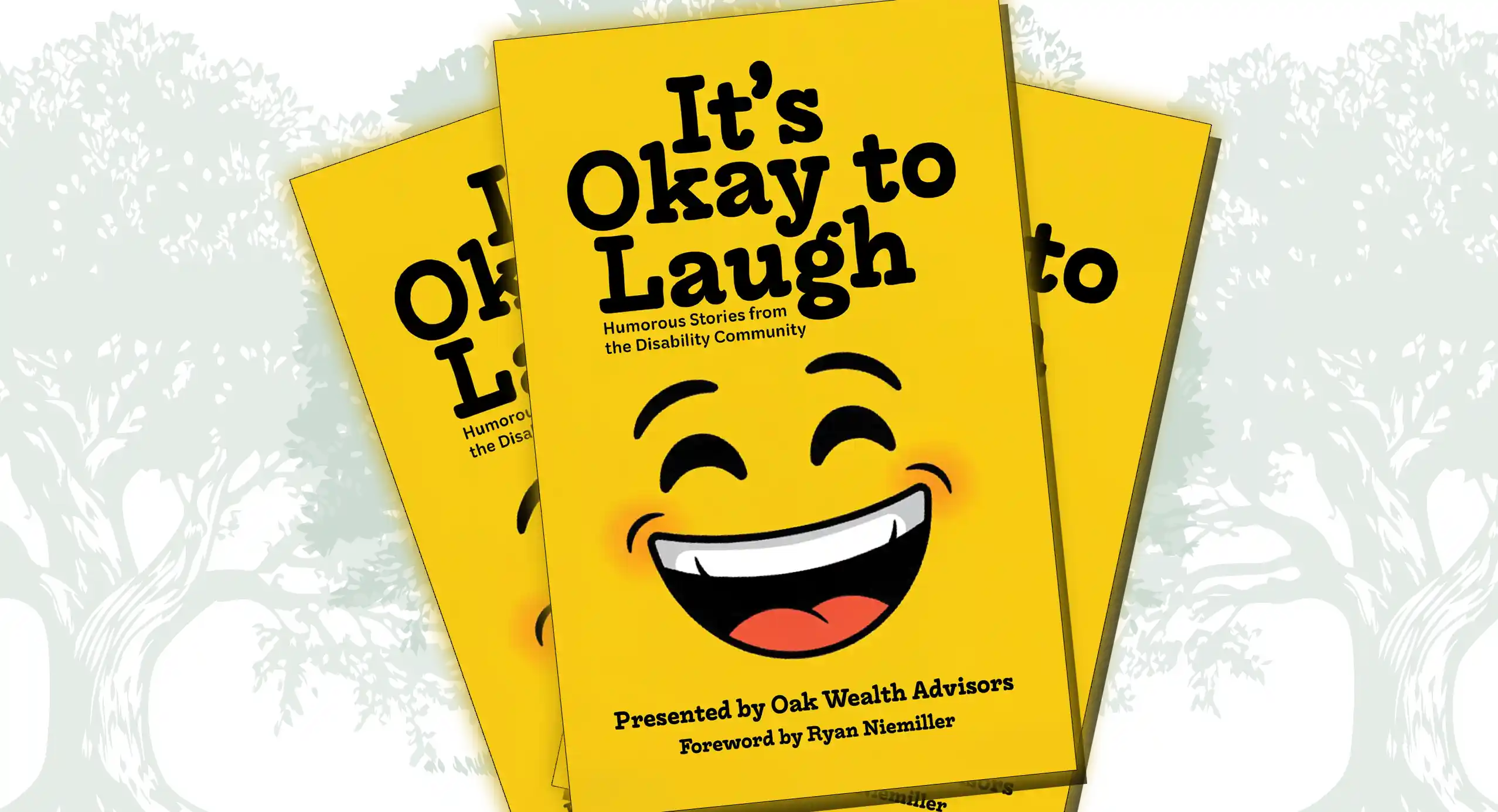

Exciting news for the disability community! The Oak Wealth Advisors book, It’s Okay to Laugh, has been published and we...

Tip #11 - Create a Safety Plan that focuses on the challenges your family member with special needs may face...

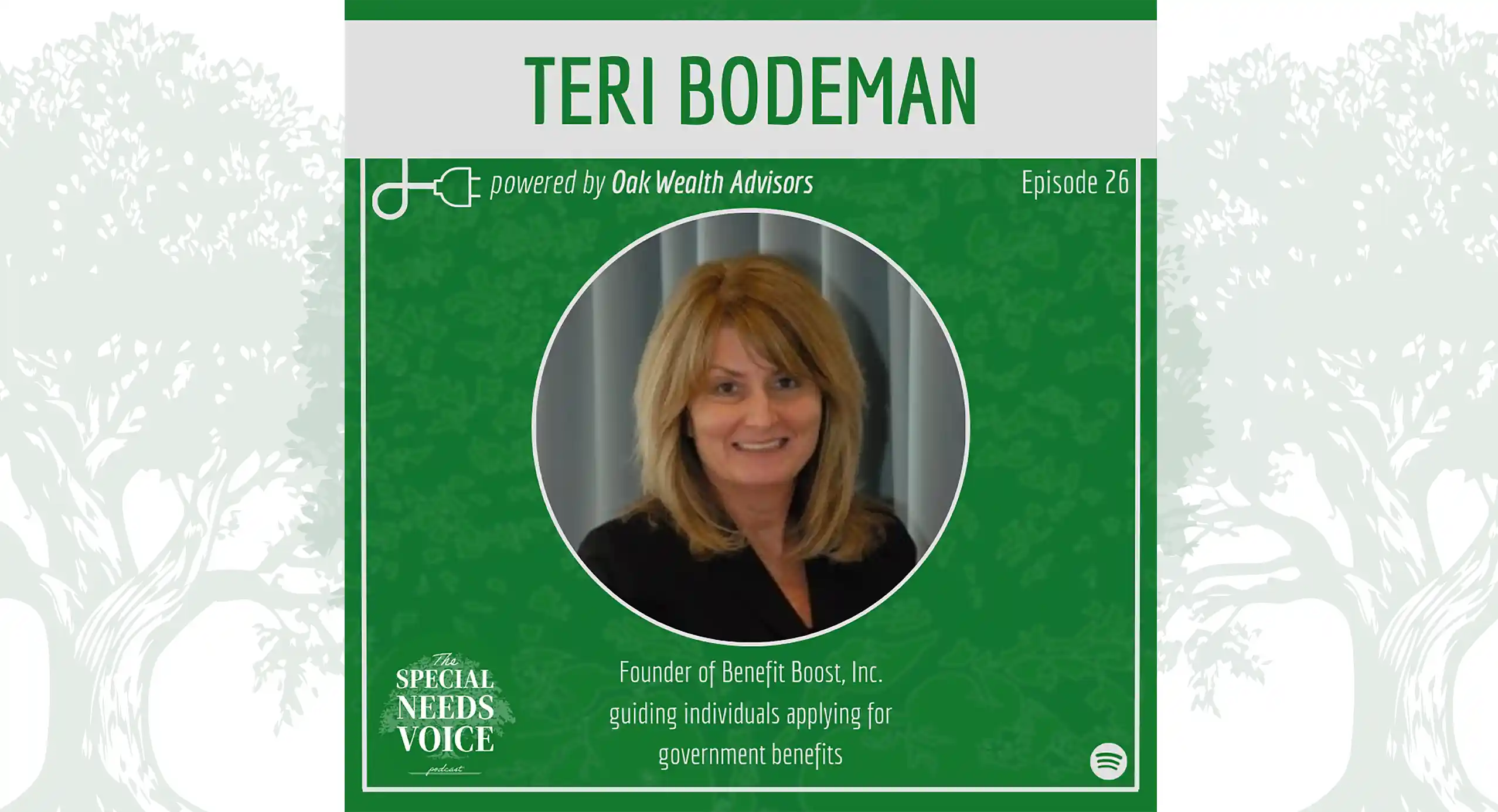

Our Guest Speaker: Founder of Benefit Boost, Inc., Teri Bodeman assists individuals with disabilities and their families in the process...

People with disabilities are entitled to a free, lifetime, National Parks and Federal Recreational Lands Access Pass to visit over...

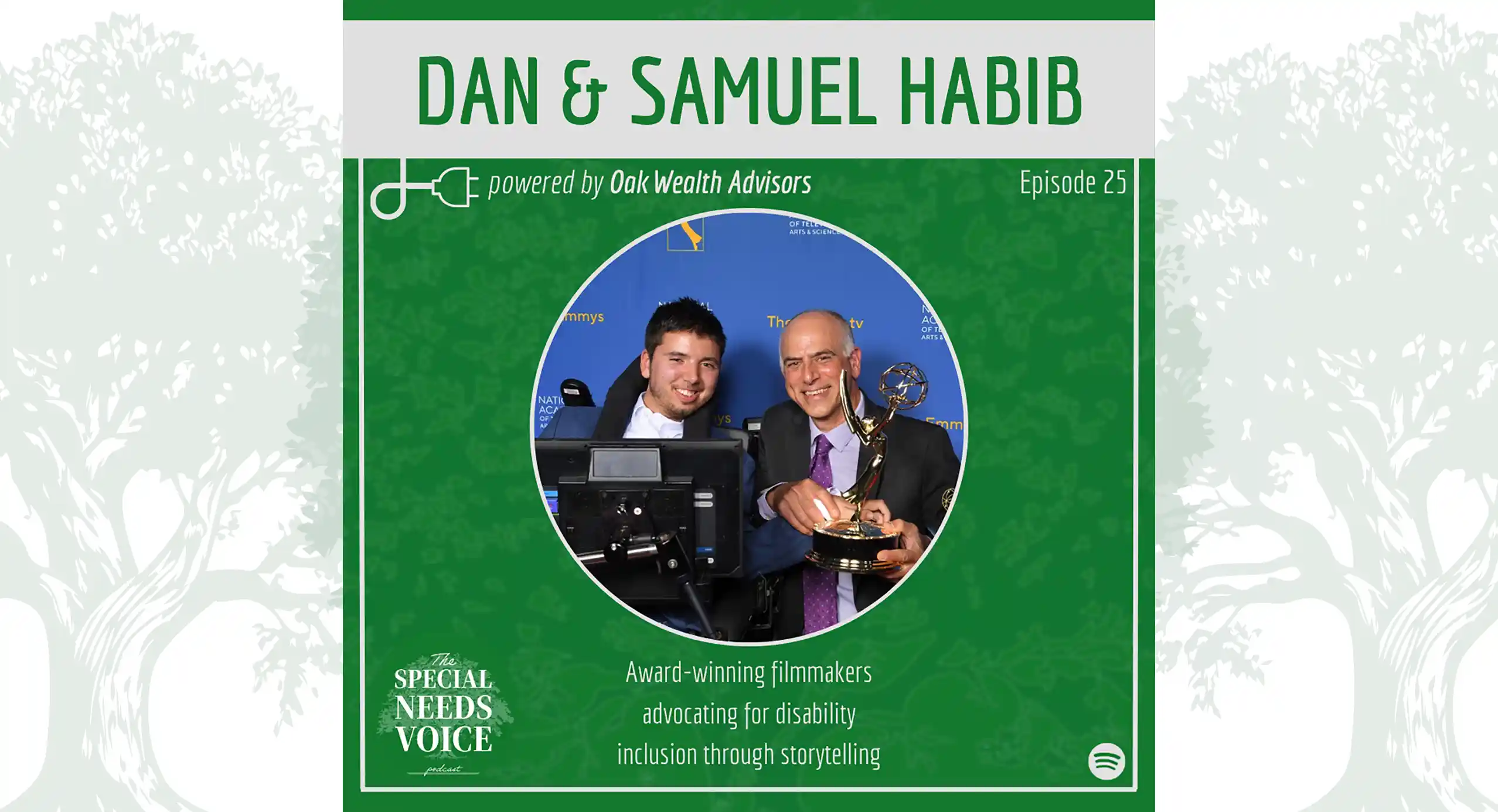

Guest Speakers - Dan & Samuel Habib, The Emmy award winning father-son filmmaking team behind My Disability Roadmap and The...

We have new income tax planning software that we have been rolling out with clients in 2025. This software identifies...

Special Needs Financial Planning Tip No 10 by Mike Walther of Oak Wealth Advisors: Coordinate your planning with your relatives’...

Mike Walther, Founder and President of Oak Wealth Advisors with your 2025 first quarter market update. ...

Guest Speaker - Rick Hayduk, CEO of Good Shepherd Hospitality, known for the Good Shepherd hotel located in Clemson, South...

In this month's installment, Randi Gillespie shares our next tip #9, from our Top 10 Special Needs Financial Planning Series....

We are excited to welcome Jonathan Chavez Montenegro as our new intern in the Madison, WI office! Read more about...