Oak Wealth Advisors Market Update: Q3 2025

Market Insights

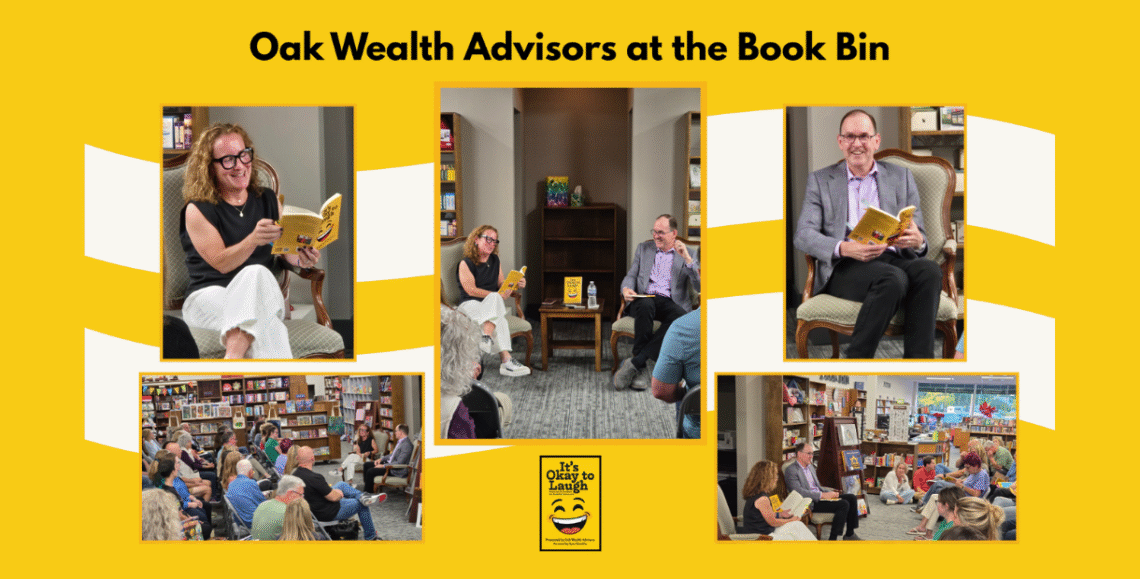

Oak Wealth Advisors at the Book Bin

Announcements

ABLE Accounts: What’s New and What’s Extended

Announcements

A Journey of Joy, Resilience, and a Dash of Humor!

Podcasts & Tips

Transitioning from Pediatric to Adult Healthcare

Podcasts & Tips

Randi Gillespie Featured on 93.9 FM Discussing It’s Okay to Laugh

In The Media

Down Syndrome Awareness Month – October 2025

Announcements

Charitable Giving for 2025 & 2026

Podcasts & Tips